top of page

Everything about LIC Money Back Policy

LIC Money Back Policy the most sold policy. These policies are more popular in rural areas than in urban due to payout at a regular interval during the policy term. Since the inception of the LIC of India, these policies are available for sale with different features. There are many money back policy still serviced by LIC of India. Although we do not have any exact plan wise data, they can be 20-30% of LIC total policies (All money back policy included). LIC of India settled

Dipti R Barik

Sep 28, 20204 min read

Loyalty Addition in Jeevan Saral Policy

Bonus rates of LIC of India for the year 2020-21 have been declared for all its participating policies. Loyalty Addition (LA) of all the eligible policies are declared too, including Jeevan Saral (Plan No. 165). Loyalty addition in Jeevan Saral Policy is available when the policy exits through death, maturity, or surrender after 10 years Loyalty Addition (LA) in Jeevan Saral Loyalty Addition (LA) in Jeevan Saral's policy depends on the duration of the policy completed with th

Dipti R Barik

Sep 18, 20202 min read

LIC Profile 2020

Life Insurance Corporation of India, well known by its acronym LIC is the largest Life Insurance company of India. Established on 01/09/1956, this 64 years old company is still getting strong despite the competition. Though there is lots of competition in Indian Insurance market, but LIC is still a synonym for Life Insurance. LIC Profile is getting better day by day. LIC of India has a strong network through out India. With offices covering almost every district of India, LIC

Dipti R Barik

Sep 6, 20203 min read

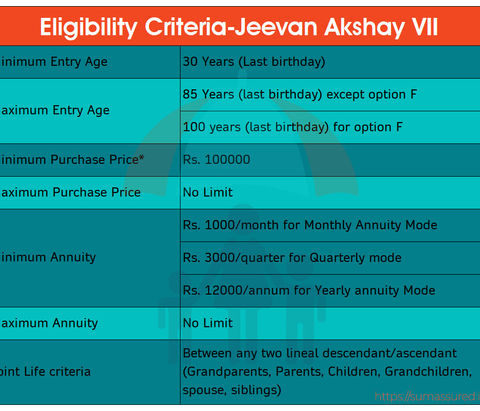

LIC's New annuity plan Jeevan Akshay VII (Plan No. 857)

Life Insurance corporation of India is going to launch its new immediate annuity plan Jeevan Akshay VII (Plan No. 857). Jeevan Akshay VII is a Single Premium, Non-linked, Non-participating, Individual immediate annuity plan. This plan is available for sale from 25/08/2020. This plan will be having 10 immediate annuity payment options to choose from (Option A to J). These options are similar to old Jeevan Akshay VI. With the launch of this plan, LIC is also withdrawing the imm

Dipti R Barik

Aug 20, 20203 min read

एलआईसी की यूलिप पॉलिसी निवेश प्लस (प्लान 849)

भारतीय जीवन बीमा निगम की निवेश प्लस एक एकल प्रीमियम, गैर-सहभागिता, यूनिट लिंक्ड, व्यक्तिगत जीवन बीमा योजना है। यह एक जीवन बीमा योजना के साथ साथ एक निवेश योजना भी है। दूसरे शब्दों में, आप पॉलिसी अवधि के दौरान जीवन बीमा कवर और रिटर्न दोनों का आनंद लेते हैं। एलआईसी का निवेश प्लस ऑनलाइन के साथ-साथ ऑफलाइन भी बिक्री के लिए उपलब्ध है।

Dipti R Barik

Aug 15, 20207 min read

How to make a claim in LIC Jeevan Arogya?

Jeevan Arogya plan is a Health Insurance Plan offered by LIC of India. Jeevan Arogya is a fixed benefit plan. In other words, on hospitalization, you will get a fixed amount on Hospitalization and surgery. LIC currently serves two Jeevan Arogya Plans. Jeevan Arogya, Plan No. 903, and Jeevan Arogya, Plan No. 904. Jeevan Arogya, Plan no. 903 is now available for sale. After hospitalization, Principal Insured has to claim the amount from LIC of India. You have to submit the clai

Dipti R Barik

Aug 1, 20204 min read

एलआईसी से डुप्लिकेट पॉलिसी बॉन्ड कैसे प्राप्त करें?

क्या आपने अपना एलआईसी पॉलिसी बॉन्ड खो दिया है? अब आप एलआईसी से डुप्लिकेट पॉलिसी बॉन्ड प्राप्त करना चाहते हैं? आपका पॉलिसी बॉन्ड एक बहुत ही महत्वपूर्ण दस्तावेज है। यह आपके और भारतीय जीवन बीमा निगम के बीच किये गए बीमा समझौते का मुख्य प्रमाण है। जब भी आप या आपका नामांकित व्यक्ति किसी दावे के लिए एलआईसी के पास जाता है, तो आपको या आपके नॉमिनी को मूल पॉलिसी बॉन्ड का प्रस्तुत करना होता है। पॉलिसी बॉन्ड या क्षतिपूर्ति बॉन्ड जमा किए बिना परिपक्वता और मृत्यु दावों का निपटान नहीं किया ज

Dipti R Barik

Jul 28, 20205 min read

How to get duplicate policy bond from LIC of India?

Have you lost your LIC policy bond? Want to get a duplicate policy bond from LIC of India? Your policy bond is a very important document. It is the main proof of the agreement between you and the Life insurance corporation of India. Whenever you or your nominee approach to LIC for a claim, you have to produce the original policy bond. Maturity and death claims cannot be settled without submitting the policy bond or indemnity bond. In other words, if in any case, a claim arise

Dipti R Barik

Jul 24, 20204 min read

Paytm से एलआईसी प्रीमियम का भुगतान कैसे करें?

डिजिटिलाइजेशन कि इस दुनिया में पेमेंट्स के कई नये माध्यम आ चुके हैंं, इनमेंं मोबाइल वेलेट्स एक बहुत ही सरल एवं त्वरित माध्यम है। मोबाइल वेलेट्स के जरिये आप कहीं भी एवं कभी भी बिलों का भुगतान कर सकते हैं। पेटीएम द्वारा अपनी सेवाओं मेंं बीमा प्रीमियम भुगतान का विकल्प जोड़ दिया है। आप पेटीम के माध्यम से एलआईसी प्रीमियम एवं अन्य सभी बीमा कम्पनीयों का प्रीमियम सीधे अपने मोबाईल से कर सकते हैं। आप पेटीएम के माध्यम से कुछ सरल चरणों मे अपनी एलआईसी प्रीमियम जमा कर सकते हैं। जानिये कैसे

Dipti R Barik

Jul 20, 20204 min read

Some important terminology related to your LIC Policy

There are many terms that you may not be aware of related to your LIC policy. Sometimes when you are in LIC office or talking to an agent or calling LIC customer care numbers, you may feel lost if you don't know the meaning of the exact term. But to understand your LIC policy better, you must identify specific words that LIC people regularly use. Today I will try to elaborate on the standard terms regularly used by LIC agent or employee to answer your query. I hope it will he

Dipti R Barik

Jul 14, 20204 min read

How to check LIC policy status online?

Do you want to check your LIC policy status online? It's now very simple. You don’t have to register on the LIC customer portal ( How to Register for LIC customer Portal? ) nor have to download any app on your phone. So let's see how you can check LIC policy status online within a minute because Keeping track of your policy is important. Step 1: Open LIC of India website To check LIC policy status, open the LIC of India website on your mobile or desktop. Simply write www.lici

Dipti R Barik

Jul 10, 20203 min read

How to pay LIC premium through Paytm?

In the world of digitalization, there are many forms of digital payment that help you to pay your bill anytime and anywhere. Mobile wallets are one of these payment systems which help you to do all your payment-related work directly from your mobile. Recently Paytm , one of the mobile wallets in India allowed its users to pay the Insurance premium. Now you can pay LIC premium through Paytm of all the life insurers through Paytm including LIC of India . Let us know how to p

Dipti R Barik

Jul 5, 20203 min read

एलआईसी ई-सेवाओं के लिए रजिस्ट्रेशन कैसे करें?

वर्तमान समय में ऑनलाइन सेवाएँ सभी के लिए बहुत ही हितकर साबित हो रही हैं। भारतीय जीवन बीमा निगम भी अपने पॉलिसीधारकों को एलआईसी ई-सेवाओं (LIC e-Services) के माध्यम से बहुत सी ऑनलाइन सेवाएं प्रदान करती है। एलआईसी पॉलिसीधारक LIC ई-सेवाओं का उपयोग करने के लिए किस तरह से रजिस्टर कर सकते हैं, यह इस पोस्ट के माध्यम से बताया गया है। एलआईसी ई-सेवाओं (LIC e-Services) के लिए कौन पंजीकरण कर सकता है? एलआईसी के समस्त पॉलिसीधारक इन सेवाओं के लिए पंजीकरण कर सकते हैं। एलआईसी ई-सेवाओं के लिए पं

Dipti R Barik

Jun 20, 20204 min read

एक फरवरी 2020 से एलआईसी ने जारी किये नए प्लान!

भारतीय बीमा नियामक एवं विकास प्राधिकरण ने सभी बीमा कम्पनीयों को नए नियमों के अनुसार 01/02/2020 से नयी बीमा पॉलिसीयाँ जारी के दिशानिर्देशों दिए थे इसी के अनुसार देश की सबसे बड़ी जीवन बीमा कंपनी ने भी अपनी सभी पुरानी बीमा पॉलिसीयाँ जो भारतीय बीमा नियामक एवं विकास प्राधिकरण के अनुरूप नहीं थी उन्हें 31/01/2020 से बंद कर दिया है एवं 01/02/2020 से नए प्लान जारी कर दिए है। भारतीय जीवन बीमा निगम द्वारा जारी सभी नए प्लान्स पुराने नाम के अनुरूप ही हैं किन्तु उन सभी के प्लान नंबर एवं U

Dipti R Barik

Feb 1, 20202 min read

LIC’s New Plan-LIC Jeevan Amar (Plan 855)

LIC of India has launched it's New Term Insurance Plan LIC’s Jeevan Amar (Plan-855). This plan is going to be a game-changer for LIC of India due to its very low premiums compared to its previous term plan Anmol Jeevan and Amulya Jeevan. Jeevan Amar is available for sale from 05/08/2019 onwards. LIC of India has already withdrawn its earlier high sum assured term plan New Amulya Jeevan with effect from 04/08/2019. LIC’s Jeevan Amar is a Non-Linked, Non-Participating Term Life

Dipti R Barik

Jul 13, 20192 min read

LIC’s New Plan Nav Jeevan (Plan No. 853)

LIC of India is going to launch its new life insurance plan LIC's Nav Jeevan, Plan No. 853 on 18/03/2019. LIC's Nav Jeevan is a non linked, with profit, Endowment Life Assurance plan. Under this plan policyholder will have the option to choose between two premium payment options ie single premium or limited premium payment term of 5 years. Unique Identification Number (UIN) of LIC's Nav Jeevan is 512N331V01. हिन्दी में पढ़ें:एलआईसी नवजीवन (प्लान न. 853) 1. LIC's Nav Jeevan -El

Dipti R Barik

Mar 16, 20193 min read

LIC Call Center Services 24X7 for LIC policyholders

Getting your policy information is very important to properly maintain your policy and pay the premium on time. Till now Life Insurance Corporation of India does not have any Call Centre services for their customers. Though they were having LIC Customer Zones, they were operational between 8 a.m. to 8 p.m. Recently Life Insurance Corporation of India has started its LIC Call Centre services for 24X7. Now it's very easy to get your LIC policy details through this LIC call

Dipti R Barik

Jan 11, 20192 min read

Paying your LIC premium through cheque? You should know this!

After the cash payment for due LIC premium, a common mode of payment is LIC premium through Cheque. Normally a customer only writes "LIC of India" or "Life insurance Corporation of India" on the cheque. However, in a recent development LIC of India has issued a new circular on 28/09/2018. As per the new circular, a policyholder now has to mention his/her policy number on the cheque. On the front of the cheque, a customer has to write his policy number just after LIC of India.

Dipti R Barik

Oct 29, 20182 min read

LIC’s New Plan Jeevan Pragati (Plan No. 838)

Jeevan Pragati, this is the name of the New life insurance plan of Life Insurance Corporation of India, Table No. 838. It is going to be launched on 03/02/2016. Jeevan Pragati is a non linked, with profit endowment assurance plan, where death sum assured automatically increases after every five years during the term of the policy. Unique Identification number of Jeevan Pragati Plan is 512N306V01. Death Benefit in Jeevan Pragati Plan On the death of the Life assured during the

Dipti R Barik

Sep 24, 20182 min read

LIC’s New Plan Jeevan Shanti (Plan No. 850)

LIC of India has launched its new annuity plan Jeevan Shanti , Plan No. 850 with effect from 11/09/2018. Jeevan Shanti is a non-linked, non-participating, single premium annuity plan where the policyholder has the option to choose an immediate annuity or Deferred Annuity. Jeevan Shanti is allowed to all lives including the third gender. Annuit rates in Jeevan Shanti Plan are guaranteed at the time of taking the policy for both Immediate and Deferred Annuity. Unique Identifi

Dipti R Barik

Sep 11, 20183 min read

bottom of page