top of page

LIC’s New Plan Aadhaar Shila (Plan No. 844)

Life Insurance Corporation of India is going to launch its new plan Aadhaar Shila (Plan No. 844) on 24/04/2017. LIC's Aadhaar Shila is non-linked, with-profits, regular premium endowment assurance plan. LIC has designed this plan exclusively for females lives having Aadhaar Card issued by UIDAI (Unique Identification Authority of India). Aadhaar Shila plan is only available for standard healthy lives without any medical examination. An individual can have a maximum of Rs. 3,

Dipti R Barik

Apr 22, 20174 min read

LIC’s New Plan Aadhaar Stambh (Plan No. 843)

Life Insurance Corporation of India is going to launch its new plan Aadhaar Stambh (Plan No. 843) on 24/04/2017. LIC's Aadhaar Stambh is non-linked, with-profits, regular premium endowment assurance plan. LIC has designed this plan exclusively for males lives having Aadhaar Card issued by UIDAI (Unique Identification Authority of India). Aadhaar Stambh plan is only available for standard healthy lives without any medical examination. An individual can have a maximum of Rs. 3

Dipti R Barik

Apr 22, 20174 min read

How to know FUP of your LIC policy using android app

Have you forgotten the FUP (First unpaid premium) of your LIC policy? Now there is an easy way to know it using your android phone. So, what you need to do to know the FUP of your LIC policy? My LIC android Application My LIC is an android application. It is developed by LIC of India for only and only one thing, ie, to know FUP of your policy instantly. So where to get this app on your mobile? You can download this app directly from Google Play or you can visit the link by c

Dipti R Barik

Mar 9, 20172 min read

Varishtha Pension Bima Yojana 2017

Govt of India on 24/01/2017 approved the launch of Varishtha Pension Bima Yojana 2017 for senior citizens aged over 60. Like previously launched Varishtha pension bima yojana this scheme provide pension to senior citizens with a rate higher than the prevailing market rates of the annuity. Varishtha Pension Bima Yojana will provide 8% guaranteed return to the annuitant for 10 years as part of government's financial inclusion program and social security schemes. VPBY-2017 is pr

Dipti R Barik

Jan 25, 20172 min read

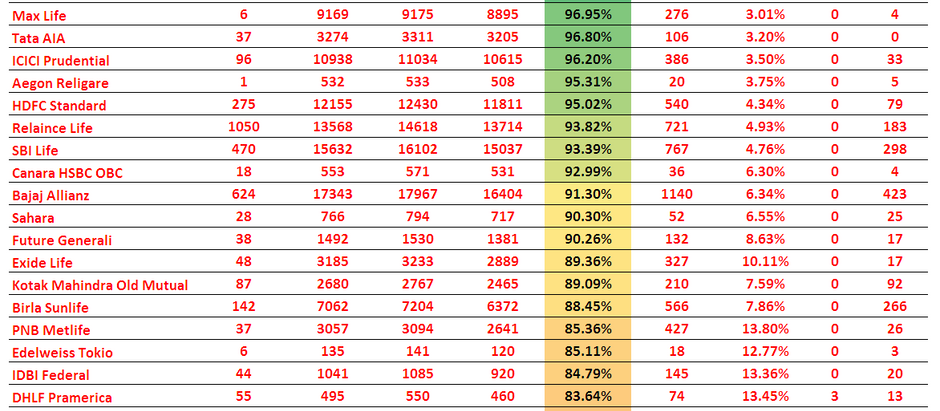

Death Claim Settlement Ratio Of Life Insurers In Year 2015-2016

On 15/12/2016 Insurance Regulatory and Development Authority of India (IRDAI) have published its annual report for the year 2015-2016. Along with all the other data related to life insurers, general insurers, and health insurer, IRDAI has also published the data related to individual death claim settled by all the 24 Life Insurance companies in the year 2015-2016. Individual death Claim Settlement Ratio of Life Insurers Death claim settlement ratio is the percentage of claim

Dipti R Barik

Dec 21, 20163 min read

LIC reintroduces Jeevan Akshay VI with modifications

Life Insurance Corporation of India (LIC) has reintroduced its immediate annuity plan Jeevan Akshay VI with certain modification. Though LIC have not changed the name and plan number of this modified version and will be available with same name and plan number i.e. Jeevan Akshay VI, Plan number 189. IRDA UIN for this modified version is 512N234V05 . This modified version of Jeevan Akshay VI is available for sale from 24/10/2016. Types of Annuity and mode of payment availabl

Dipti R Barik

Oct 24, 20163 min read

Now update your contact details online in your LIC policy

Keeping your contact details updated in your insurance policy helps you to get important notification related to your policy on time. Till now you have to register your LIC policy on the LIC portal to update your contact details in your policy or send the request to servicing branch. But, in the recent initiative "Help us to serve you better" LIC of India now allowing the policyholder to update their contact details in their policies without registering on the LIC portal. How

Dipti R Barik

Sep 13, 20162 min read

LIC declared one time Diamond Jubilee Bonus

Life Insurance Corporation of India has declared the Bonus rates for the valuation period 1st April 2015 to 31st March 2016. Along with it, LIC has also declared the one time Diamond Jubilee Bonus for its policyholders. Diamond Jubilee Bonus is declared from Rs. 5 per thousand sum assured to Rs. 60 per thousand sum assured. It mainly depends on the time of inception of the policy. Diamond Jubilee Bonus Which policies are eligible for One time Diamond Jubilee Bonus? The One Ti

Dipti R Barik

Sep 7, 20162 min read

LIC of India’s Bonus rates declared for 2016-17

This year LIC of India has declared Bonus rate for all its with profit policies before the usual time as LIC is celebrating its Diamond Jubilee year. Every year Actuarial Department of LIC do the valuation and declares the bonus rates. These bonus rates are applicable for policy year entered upon during the inter-valuation period i.e. 01/04/2015 to 31/03/2016 and in force for full sum assured as on 31/03/2016. It will be applicable to policies resulting from claims by death o

Dipti R Barik

Sep 3, 20162 min read

All you need to know about sites comparing insurance products

You might have come across many websites which are comparing the insurance plans premiums and collecting data about the interested person through their online portals. These sites are called Web Aggregators . “Web Aggregator” – For the purpose of these guidelines, a web aggregator is a Company registered under Companies Act, 1956 (1 of 1956), approved by the Authority under these guidelines, in whose behalf a website offers information pertaining to insurance products and / o

Dipti R Barik

Aug 30, 20163 min read

LIC changed agency MBG criteria for agents

Ahead of its Diamond Jubilee year Life Insurance Corporation of India has given a good gift to its agents by changing various norm related to MBG criteria and eligibility norms related to recruitment of agent. This step will be beneficial for both agents as well as Development Officer of LIC. Earlier the MBG criteria for the LIC agents was 12 lives and . 100000/- FYPI in an agency year. Latest News: LIC Launched New Plan Bima Shree (Plan 848). Click the image or link to Know

Dipti R Barik

Aug 23, 20163 min read

Direct debit facility for LIC premium payment

Have you missed to deposit your last LIC premium on time? Do find remembering the premium due dates a tiresome process? Do you have multiple policies with different due dates? You want to take policy in ECS mode but your bank is not connected to any ECS center? Then Direct debit facility is the solution for you, only requirement is you must have a bank account in ICICI, corporation bank or State bank of India. Till now LIC of India have tie up with these three banks only for

Dipti R Barik

Aug 22, 20162 min read

Types of revival for lapsed LIC policies

To keep the risk cover in force in your LIC policy a policyholder must pay his/her insurance premium on time or within the grace period. If a policyholder failed to do so then his policy became lapse, and no risk cover is available under that policy. To restart the risk cover in the policy, a policyholder has to revive the policy by paying all the due premiums up to the date of revival. Nowadays policies can be revived in other branches if the policy is to be revived on DGH a

Dipti R Barik

Aug 11, 20164 min read

How to protect yourself from insurance frauds

Lots of Insurance frauds are in the news of various newspapers, Fraudsters using various means to cheat people, they are using phone calls claiming themselves officers of IRDA, preparing duplicate policy bonds, imposing as an insurance agent with false ID cards and much more that we cannot imagine. Insurance scam: Crime branch arrests man for duping former government employee off Rs 77 lakh Fake LIC agents dupe techies with bogus IDs-The Times of India Insurance scam: IRDA wa

Dipti R Barik

Aug 3, 20163 min read

LIC's New Plan Jeevan Labh (Plan no. 836)

LIC of India's Jeevan Labh (Plan No. 836) is a limited premium paying, non-linked, with-profit endowment assurance Plan. Unique identification number (UIN) of Jeevan Labh plan is 512N304V01. This policy is available from a child of 8 years old to a person of age 59. The main feature of this plan is a very limited premium payment option, for the 16-year policy term customer have to pay the premium for 10 years and for 21 and 25 years of policy term policyholder have to pay the

Dipti R Barik

Jul 17, 20162 min read

LIC of India's New insurance plan "Jeevan Tarun" (Plan No. 834)

The new policy is named as Jeevan Tarun (Plan No. 834), and it's a non-linked, with profit, limited premium payment policy, specially designed to meet the requirement of growing children. Premium paying term is 5 years less that the policy term. In this plan, proposer can choose any of the four options for survival benefit between the 20 to 24 years of child age and the maturity at the age of 25 years of child's age. The four options are as follows: Option Survival Benefit Ma

Dipti R Barik

Jul 11, 20163 min read

Diferment of escalation clause for LIC of India's Club Member agents

In my earlier post "Conditions for Club membership for FY 2015-16 for LIC agents" I mentioned about the escalation clause and commission required to qualify for the particular club for the financial year 2015-16 for new as well as continuing club members. The escalation clause is a yearly increase in commission by 5% compared to last year, and it was effective from 2013-14 for new entrants and 2014-15 for continuing club members. But as per the new circular of LIC Mkt/A/21(R

Dipti R Barik

Jun 7, 20161 min read

Club Galaxy for LIC agents: All you need to know

Club membership for agents is one of the ways Life Insurance Corporation of India rewards its agent for higher and consistent performance. Until May 2014 the highest club was the corporate club and after that Chairman Club was there. There is a huge difference between the eligibility criteria of the corporate club and the Chairman Club. In May 2014, LIC of India introduced a new club between the corporate club and Chairman Club named Club Galaxy. One of the reasons behind th

Dipti R Barik

May 16, 20162 min read

Proposal Form: Basis of your insurance contract

Insurance is a contract between insurance company and the person want to cover future risk on his life, where the insurer is bound to pay a fixed amount on death of the Life Assured to his nominee in return of premium (one time or regular). This contract starts when insurer accepts the proposal from the proposer on the basis of the details furnished by the proposer in the proposal form (A prescribed format for proposing a life insurance contract). And since the insurance is b

Dipti R Barik

May 10, 20166 min read

LIC's rate of interest for various financial transaction for FY 2016-17

Life Insurance Corporation of India (LIC) every year declares the rate of interest to charged on the various financial transaction in the coming financial year. These financial transactions include policy loan, revival, backdating of policy and many other transactions. The rate of interest in these financial transactions are declared by the actuarial department of LIC. Rate of Interest for the various financial transaction for FY 2016-17 S No. Type of Transaction Rate of Inte

Dipti R Barik

May 7, 20162 min read

bottom of page