top of page

Terminology that every LIC club member agent must know

LIC of India has more than 12 lac agents, and according to their performance, LIC rewards them in different forms. One is Club membership. According to the business procured by agents in the last 4 years LIC awards club membership to agents. These Clubs are Corporate Club, Galaxy Club, Chairman Club, Zonal Manager Club, Divisional Manager Club, Branch Manager Club and Distinguish Club. LIC has made the criteria for entry to a new club or continuation in a new club. These crit

Dipti R Barik

Feb 23, 20165 min read

LIC relaunched its special revival campaign

After getting the huge response to its earlier launched Special Revival Campaign from 01/09/2015 to 31/10/2015 which was later extended up to 30/11/2015, LIC of India the state owned insurer again launched it's Revival campaign from 01/01/2016 to 29/02/2016. In this revival campaign Life Insurance Corporation of India provided some concession in late fee and evidence of health while reviving the policy within this period. It is a very good initiative by Life Insurance corpora

Dipti R Barik

Dec 30, 20153 min read

Refund of Service tax in Varishtha pension Bima yojana

Varishtha Pension Bima Yojana (Plan 828) was launched by Government of India on 15/08/2014 for person aged more than 60 years to provide a social security through lifetime pension to senior citizens. Varishtha Pension Bima Yojana was sold and administered by Life Insurance Corporation of India. From 15/08/2014 to 31/03/2015 service tax at the rate of 3.5% was collected from the customers on premium, which ranged from Rs. 2333 to Rs. 23333. In the Budget 2015 finance minister

Dipti R Barik

Dec 23, 20151 min read

What is Open title and its effect on claim payment time?

Sometimes when a legal heir of a diseased life assured approaches the life insurer for payment of death claim in a particular policy, they are asked to bring the succession certificate to make the payment due to open title in policy. What is Open title in life Insurance policy? Open title is absence of valid nomination or assignment in life insurance policy. Open title in a life insurance policy may arrise due: Not affecting nomination in a policy: At the time of taking the

Dipti R Barik

Dec 22, 20153 min read

Anywhere revival of your lapsed LIC policy

Revival in very important process by which one can restart the risk cover in his/her lapsed policy by paying all the arrears of premium up to the date. But some times people are unable to revive their policy because, they are away from their servicing branch. This problem is mainly faced by service class people who have transferable jobs. To over come the problem faced by the policy holders, LIC of India in Feb, 2009 allowed the anywhere revival facility of some lapsed polici

Dipti R Barik

Dec 13, 20153 min read

What is claim settlement option in LIC of India

Settlement Option! have you wondered what is this? Lump sum amount in LIC of India is payable when policy exit by way of maturity claim or death claim (or as per the policy conditions). But, if claimant (Policy holder/nominee) want this amount to be payable in installment over a period of time, then this amount is payable to claimant in installment for a period of minimum 2 year to 10 years as opted by the claimant. What is settlement option? Claim settlement option is nothin

Dipti R Barik

Dec 1, 20152 min read

Swachh bharat cess on Insurance premium

Government vide Notification No. 22/2015-Service Tax dated 6 November 2015, has imposed a Swachh Bharat Cess (SBS)at the rate of 0.5% on all services, which are presently liable to service tax with effect from 15 Novemeber,2015. Hence the revised rate (effective from 15/11/2015) shall be 14% Service tax plus 0.50% SBS i.e. 14.50%. Impact of Swachh bharat cess (SBC) on Insurance premium Insurance service falls under category of services on which service tax is levied, there f

Dipti R Barik

Nov 19, 20152 min read

Special revival campaign of LIC now extended

Special revival campaign of Life Insurance Corporation of India for revival of lapsed policy which was earlier launched from 01/09/2015 to 31/10/2015 has been extended up to 30/11/2015. This will help the policy holders to revive their policies with concession in late fee. During this campaign policy holders of Life Insurance Corporation of India will get the concession in late fee up to 30% and relaxation of some health requirements. Also Read : Special Campaign For Revival

Dipti R Barik

Oct 29, 20152 min read

LIC may soon withdraw Jeevan Akshay VI

After the gazette notification issued by Insurance Regulatory and Development Authority of India (IRDAI) on 14/10/2015 for annuity plans offered by Life Insurers, LIC of India may soon withdraw or relaunch (with modifications) its Immediate Annuity Plan Jeevan Akshay VI. The Authority may issue separate instructions for withdrawing the products which are not in compliance with these Regulations but are currently offered by the Life Insurers and which are approved by the Autho

Dipti R Barik

Oct 15, 20152 min read

Get all your LIC policy payments directly into your account through NEFT

Life Insurance Corporation is now sending all the payment to it's policy holders through NEFT payment system. The payment under your policies will be credited directly to your Bank account through electronic mode of payment only. For this purpose, you require to submit your bank details to LIC for making the policy payment through NEFT (National Electronic Fund Transfer). The details of NEFT are described below. Submit your NEFT mandate form (You can download the NEFT form fr

Dipti R Barik

Oct 4, 20153 min read

LIC of India's Bonus rate declared for 2015-16

LIC of India have declared Bonus rate for all its with profit policies. Evert year Actuarial department of LIC do valuation and declares the bonus rates. These bonus rate are applicable for policy year entered upon during the inter valuation period i.e. 01/04/2014 to 31/03/2015 and in force for full sum assured as on 31/03/2015. It would apply to policies resulting into claims by death or maturity (including those discounted within one year of maturity) or surrendered on or

Dipti R Barik

Sep 15, 20151 min read

LICMobile - A useful mobile app for LIC policyholders

With a increase in the use of smartphones, many financial institutions have come up with their mobile application to provide anytime and anywhere facility to the customer. LIC of India have also build a mobile application called as LICMobile. LICMobile application is developed by LIC itself and currently available for the android platform only through Google Play. LICMobile LICMobile application is useful for not only policy holder, but it is very useful and handy tool for LI

Dipti R Barik

Aug 28, 20153 min read

All you need to know about Non-negative claw-back Additions

As per the guidelines issued by Insurance Regulatory and Development Authority of India (IRDAI), barring the traditional insurance-cum-investment products, insurance policies now have a cost on caps in the form of reduction in yield . This is applicable on unit-linked insurance plans (ULIPs) and variable insurance plans (VIPs). At various durations starting from 5 th policy anniversary till the end of the policy term, Reduction in Yield (RIY) will be calculated as the differ

Dipti R Barik

Aug 25, 20153 min read

Varishtha Pension Bima Yojana is Closing on 14/08/15

Varishtha Pension Bima Yojana (VPBY) which was launched government on 15/08/2014 is soon going to close on 14/08/2015. Varishtha Pension Bima Yojana is a pesion secheme which is giving a return of 9% per annum if pension is opted in monthly mode and 9.38% when opted for yearly mode. Minimum amount for investment in VPBY is Rs. 63960, Rs. 65430, Rs. 66170 and Rs. 66665 for yearly, half yearly, quarterly and monthly mode respectively and miximum amount which can be invested in

Dipti R Barik

Aug 12, 20152 min read

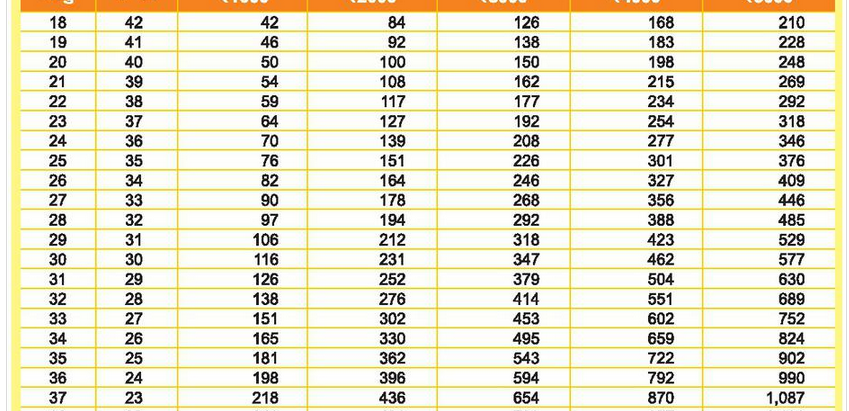

All you need to know about Pradhan Mantri Atal Pension Yojana (PMAPY)

There are many people in India working in unorganised sectors with no guarantee of any pension at old age. Though government had launched Swavalamban Yojana in 2011-2012, a very less people joined the scheme as it did not provide any certainty of amount payable at vesting age. To provide financial security to such people at older age government has announced the Atal Pension Yojana (APY), which will provide a defined pension, depending on the contribution, and its period. The

Dipti R Barik

Jun 30, 20152 min read

Increase in service tax on insurance premium from 01/06/2015

It was proposed in in Union Budget 2015 to increase the service tax from 12.36% to 14%. After the Notification No. 14/2015-Service tax dated 19/05/2015 by the government, new servic tax will be effective from 01/06/2015. All the Service including the insurance premium will be dearer from 01/06/2015. The special rates for life insurance service as per rule 6(7A) has been changed. The rate ofservice tax for FY 2015-16 are as under: Recent Updates : Increase in Service tax on In

Dipti R Barik

May 21, 20151 min read

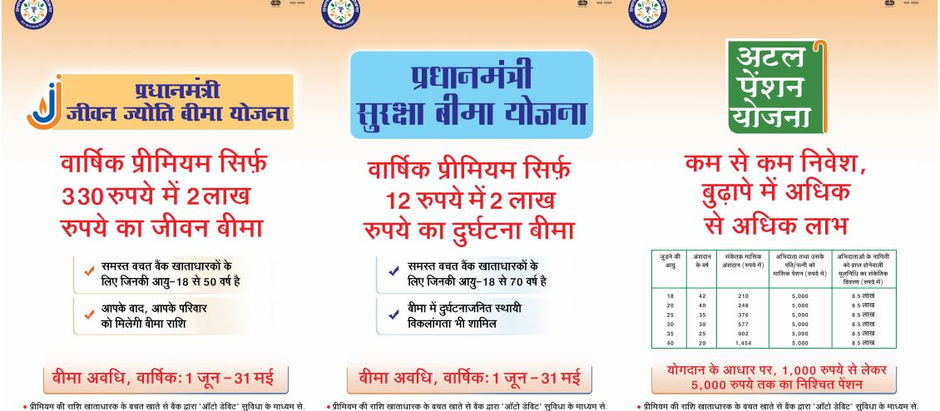

Difference between PMSBY and PMJJBY

Lots of People are asking about the difference between the Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) . In this article I have tabulated the difference between both the schemes. Both the Schemes are available to the customer through their banker with auto debit of premium from their bank account annually in the month of May every year. हिन्दी में पढें : जानिये PMSBY और PMJJBY के बीच क्या अंतर है। These are the basis diffe

Dipti R Barik

May 8, 20152 min read

All you need to know about Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Pradhan Mantri Suraksha Bima Yojana (PMBSY) is a Accidental Insurance scheme and renewable year to year. Under this scheme people between age of 18 to 70 years will get a accidental risk cover of Rs. 200000 by paying just a premium of Rs. 12 per year. If the life assured dies due to accident his/her nominee will get the sum of Rs. 200000 and in case of total and irrecoverable loss of both eyes or loss of use of both hands or feet or loss of sight of one eye and loss of use of

Dipti R Barik

May 8, 20155 min read

All you need to know about Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

On May 9, 2015 Prime Minister of India is going to launch the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) to provide insurance cover to masses with minimum premium, this insurance cover can be taken from any bank by filling out a simple form. Minimum requirement is that you should have a bank account and aged between 18 to 50 years. One can only take maximum cover of Rs. 200000 from any of the his banker if having multiple accounts in different banks, and have to give de

Dipti R Barik

May 3, 20155 min read

Which company to choose to buy Term Insurance Plan

Term Insurance Plans are the best plans to cover risk of life. Term plans not only provide high risk cover but with less premium in return. With increase in the Insurance companies premium for term plans differ very much. Difference in the premium can be double between lowest to highest, this puts the person taking insurance in dilemma of which company is best to take Term Insurance Plans. Key to choose the company to take Term Insurance Plan is not the premium is be paid, b

Dipti R Barik

Apr 26, 20152 min read

bottom of page